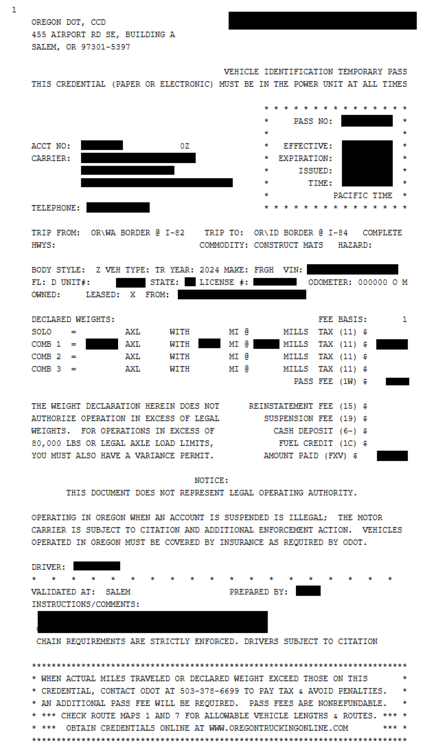

The amount a freight company has to pay per mile in Oregon under the weight-mile tax system varies based on several factors, including the weight of the vehicle and any applicable tax rates or adjustments. Oregon's weight-mile tax has different rate tables for different vehicle weights, and these rates can change periodically.

- Lighter Vehicles (26,001 to 80,000 pounds Gross Vehicle Weight): These vehicles are taxed at lower rates per mile. The rates increase incrementally with the weight of the vehicle.

- Heavier Vehicles (over 80,000 pounds Gross Vehicle Weight): These vehicles are subject to higher rates, reflecting the greater impact heavier vehicles have on road infrastructure.

Example Rate Structure:

- Vehicles weighing 26,001 to 30,000 pounds might pay a lower rate, such as $0.02 per mile.

- Vehicles weighing 80,001 pounds and above might pay significantly more, such as $0.10 per mile or higher.

Important Considerations:

- Variable Rates: The actual rates are subject to change and can vary based on legislative or regulatory adjustments. Always refer to the latest Oregon Department of Transportation (ODOT) publications or their official website for current rates.

- Tax Adjustments: There may be additional adjustments or surcharges, such as a fuel tax adjustment, that can affect the total amount due per mile.

- Exemptions and Discounts: Certain types of operations or vehicles may qualify for exemptions, reduced rates, or credits, impacting the overall cost per mile.

For the most accurate and current rates, it's essential to consult directly with the Oregon Department of Transportation. This will ensure compliance and provide a clear understanding of the specific costs associated with operating freight vehicles in Oregon.

.thumb.jpg.79710ba0be5a9f3be83fb45bcaf36e79.jpg)